I am starting to hear a lot of “gossip” about mergers and acquisitions in the managed services community. M&A activity for MSPs has an ebb and flow, very similar to the tides. People, again, seem to be very excited about the prospect of entering an M&A cycle of activity. In all likelihood, this type of talk is typically generated from M&A consultants and buyers trying to instigate business owners to sell. But, more on that another time.

So, here are some of my (predictable) opinions on the matter. Hope you enjoy!

No Data Supporting M&A Consolidation

Where is the data? I don’t see any analytical or empirical data showing anything close to an MSP consolidation period in the near future. Everyone is for sale. Yes, this is a true statement. But, that doesn’t mean that everyone will conclude a deal anytime soon.

Growth in Managed Services Does NOT Mean M&A Growth

When MSPs do well, some people believe it also is a good time to be looking for M&A deals. That is not my experience. Tough times typically see more M&A activity amongst MSP businesses, because of lack of growth, failing customers (like we saw during 2009 and 2010), or other factors.

Pressure deals arising from these scenarios usually does come out of a negative economic cycle. But, this is not what happens during a growth cycle. Yes, do you have more money available to be spent, but these investments do not always translate into M&A. In fact, during positive economic periods, you tend to see more investments in MSP organizations, not M&A.

Consolidation vs Purging

There is a big difference between market consolidation (or contraction) and market purging. Market consolidation is the shrinking of a market, where you typically see weaker demand, scarcity of a natural product or resource, or a general downward momentum in the economy.

A market purge is quite the opposite of consolidation. A purge is where older and outdated providers are no longer competitive, so they suffer from all the signs of a downward economic cycle, even though the economy is good.

An example of this would be a horse and buggy dealer facing tough times during the 1920s, even though people were buying cars. Horse and buggy dealers were just in a bad business model.

The Break/Fix Market Consolidation

I do think there is a market consolidation which has been occurring for the last decade involving break/fix companies, not MSPs. The confusion happens when we call MSPs break/fix companies and vice versa. Conflating a break/fix company to a provider of managed services is a) not helpful, and b) just wrong.

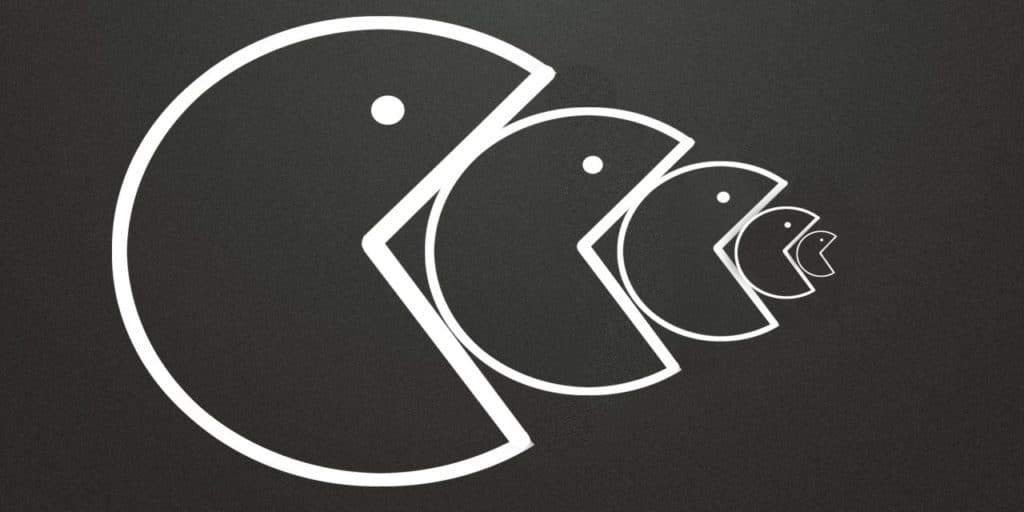

If there was an evolutionary chart, this would be representative of the horse and buggy dealer failing to see the changing times and buying habits of his customers and neglecting to get into the automobile business. As the managed services market continues to experience unprecedented growth worldwide, the more break/fix companies will be starkly compared to MSPs and suffer increasing problems in growing their business.

This is what we are seeing…this is what we have seen for some years now.